Differences Between Dwelling Fire Insurance and Homeowners Insurance

Navigating the world of insurance can feel like diving into a maze, especially when you encounter terms like “dwelling coverage” and “dwelling fire insurance.” At Portsmouth Atlantic Insurance, we understand the confusion these terms can cause. Let’s break down the differences between dwelling fire insurance and homeowners’ insurance to help you make informed decisions about protecting your property.

Unpacking Homeowners Insurance

When you hear “homeowners insurance,” it’s essential to recognize that it encompasses various coverages within a single policy. While these coverages may vary depending on your specific policy, they typically include:

- Coverage A: Dwelling

- Coverage A protects the structure of your home and attached structures like patios or porches from damage due to covered perils.

- Coverage B: Other Structures

- This coverage extends to freestanding structures on your property, such as detached garages or sheds.

- Coverage C: Personal Property

- Personal property coverage insures your belongings, covering losses caused by covered perils.

- Coverage D: Loss of Use

- If your home becomes uninhabitable due to a covered loss, this coverage reimburses additional living expenses.

- Coverage E: Personal Liability

- Personal liability coverage safeguards you against legal and medical expenses if someone sues you for injuries or property damage.

- Coverage F: Medical Payments to Others

- This coverage pays for medical expenses if someone is injured on your property, regardless of fault.

While dwelling coverage is a crucial component of homeowners insurance, it’s just one piece of the puzzle.

Understanding Dwelling Fire Insurance

Dwelling fire insurance, on the other hand, is a separate policy designed for specific circumstances. Here’s what you need to know:

Purpose and Scope

Dwelling fire insurance primarily targets non-owner-occupied properties, such as rental homes or vacation properties. It provides coverage for the structure but typically excludes personal property and liability protection.

Flexibility

While dwelling fire insurance is commonly used for rental properties, it can also apply to owner-occupied homes, especially those used seasonally or intermittently.

Supplementary Coverage

While the primary focus is on the structure itself, some policies may offer options to include limited personal property coverage or additional liability protection.

Do You Need Dwelling Fire or Homeowners Insurance?

Determining the right type of insurance depends on various factors:

- Primary Residence: If you live in your home year-round, homeowners insurance is likely the best option to ensure comprehensive protection.

- Secondary Residences: For vacation homes or properties used seasonally, dwelling fire insurance can provide suitable coverage.

- Investment Properties: Rental properties often require dwelling fire insurance to address the unique risks associated with tenant occupancy.

- Vacant Homes: Properties awaiting sale may benefit from dwelling fire insurance to guard against potential perils.

- Builders Risk: Properties undergoing construction may also benefit from dwelling fire insurance to guard against potential perils.

- Homes Under Renovation: Properties undergoing renovations may also benefit from dwelling fire insurance to guard against potential perils.

The Importance of Location

Your property’s location also plays a significant role. In areas prone to wildfires, flood or other natural disasters, securing adequate coverage, whether through homeowners or dwelling fire insurance, is crucial.

Types of Dwelling Fire Insurance

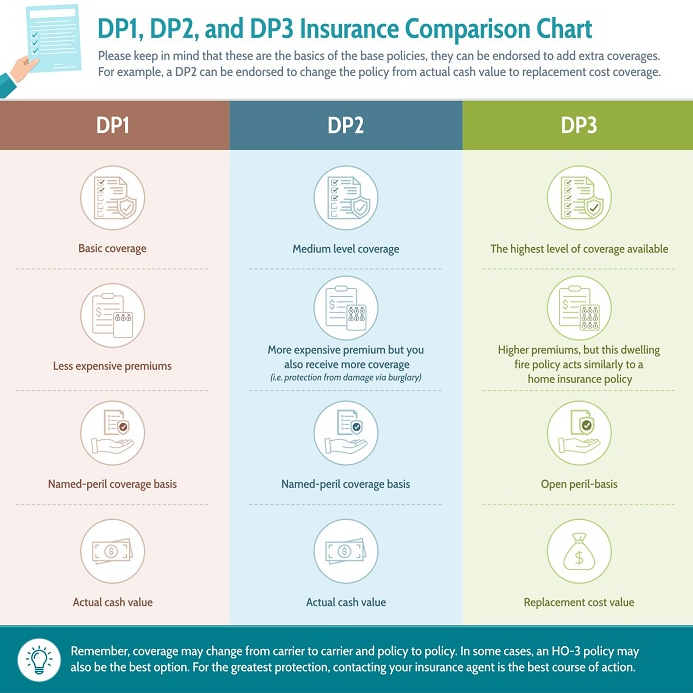

Dwelling fire insurance comes in various forms, each offering different levels of coverage:

DP-1: Basic Form

- Named perils policy covering basic risks like:

- Hail or windstorms

- Other explosions

- Smoke

- Riot/civil commotion

- Volcanic eruptions

- Aircraft or vehicles

- Typically settles claims on an actual cash value basis but may offer options for replacement cost coverage.

DP-2: Broad Form

- Extended coverage as mentioned in the basic form

- Vandalism and malicious mischief

- Weight of ice and snow

- Glass breakage

- Burglary damage

- Falling objects

- Frozen pipes

- Accidental discharge or overflow of water or steam

- Electrical damage

- Collapse

- Loss of rent coverage in the event tenants are required to move out while the landlord repairs the home from a covered loss

- Often settles claims on a replacement cost basis, providing more comprehensive protection.

DP-3: Special Form

- Open perils policy covering all risks except those explicitly excluded.

- Exclusions in a DP-3 policy typically include:

- War

- Laws and ordinances

- Water damage

- Neglect

- Intentional loss

- Gradual issues like mold, rust, and rot

- Earthquakes

- Offers the highest level of coverage for both the dwelling and personal property.

DP-1: Basic Form vs. DP-2: Broad Form vs. DP-3: Special Form

Closing Thoughts

While dwelling fire insurance and homeowners insurance serve distinct purposes, both play critical roles in safeguarding your property and assets. At Portsmouth Atlantic Insurance, our team of licensed agents is here to help you navigate these options and tailor coverage to your specific needs. Whether you’re a homeowner, landlord, or property investor, we’re committed to providing the guidance and support you need to protect what matters most.

By understanding the nuances of each policy type and assessing your unique circumstances, you can make informed decisions to ensure comprehensive coverage and peace of mind for the future. Reach out to us today to learn more about your insurance options and discover the right solution for your property protection needs.

At Portsmouth Atlantic Insurance, we’re dedicated to helping New Hampshire homeowners navigate the complexities of home insurance. If you have any questions or need assistance with your insurance needs, don’t hesitate to reach out to our team of licensed insurance agents. We’re here to help you protect what matters most.

Contact Us today for Auto and Home solutions and learn more about how we can help. Give us a call at 603-431-4020, email at insure@portsmouthatlanticins.com or fill out the form on this page to get started.

Be sure to follow us on Facebook & Instagram to stay up-to-date on the latest news and tips in the insurance industry. We’re always sharing helpful insights and advice that can help you protect yourself and your assets.

We proudly serve residents in New Hampshire, Massachusetts, Vermont, Maine, Connecticut, Rhode Island, New York, Ohio, Illinois & Florida