According to data from the Insurance Information Institute (III), water damage affects approximately 14,000 people in the U.S every day. And on average water damage claims cost over $12,000. What’s worse – water damage claims have been on the rise, nearly doubling between 2017 and 2021.

With numbers like that, it’s a safe bet that most homeowners will experience water damage at some point in their lives.

Navigating insurance coverage for water-related incidents can be a little confusing. What is covered by flood insurance? Do I need different insurance coverage for water damage? It’s important to ensure you have the right coverage in place to protect your home from any risk.

Below we’ll discuss water backup and sump pump overflow (two common causes of water damage for homeowners), how you can prevent water damage, and what insurance coverage you’ll need.

Common Causes of Water Backup

Water backups in your home or yard are typically caused by damaged or malfunctioning utility systems and equipment. Most often these are the result of:

Heavy rain

Severe storms can cause debris to build up, blocking your drains and sending water back into your home. In some cases, this can also cause sewage to back up, creating a stinky, expensive and dangerous situation for your family.

Sewer and gutter backups

Blockages in the main sewer lines running through your neighborhood can cause sewage to back up into homes through floor drains. In most cases, this occurs slowly giving homeowners time to clean up and correct the problem before serious problems occur.

Damage

System damage caused by tree roots, heavy vehicles and other everyday risks. When trees lead to water backups, responsibility often falls on the person or entity that owns the tree. For example, if the tree is on your property, you will be responsible for the cost of repairs. If the tree is city-owned, they will assume responsibility.

Aging systems

Infrastructure in many areas of the country is getting old and breaking down faster than we can fix it. As pipes and other sewer system equipment ages, the risk of failure increases. When these failures happen, it can lead to water backups that damage homes.

Sump pump overflow

This is a specific type of equipment failure caused by the sump pump found in many homes’ basements. Sump pumps are an important tool to protect your home. When the sump pump fails, it can no longer detect excess water and move it away from your property. This can lead to an overflow event.

Water Backup Coverage vs. Flood Insurance

A standard homeowners insurance policy doesn’t include protection against water backups. Luckily, you can add a water backup endorsement that protects your home and family from sewage backup and sump pump overflows. This coverage will pay for structural damage to the home and may cover damaged items of personal property.

Homeowners in rainy, stormy, snowy areas or with frequent power outages should get water backup insurance.

Flood insurance is a supplemental policy typically written through FEMA’s National Flood Insurance Program. Flood insurance protects your home, utility systems, and sometimes personal belongings such as electronics and clothes. It does not cover mold, mildew or other “preventable” damage, valuables, living expenses, vehicles, or outdoor items like patio furniture.

Flood insurance coverage is beneficial to any homeowner. But you should strongly consider a policy if you live in a moderate- or high-risk flood zone. Our team of licensed insurance advisors can help review your risk and current insurance coverage to determine which policy is right for you.

Warning Signs of a Backup and What You Can Do

Warning signs of a potential water backup include:

- Strong sewage odors coming from your toilet, tub, and other drains

- Sink and toilet overflows

- Gurgling pipes and slow drains

- Pooling water and mold/mildew growth

- Foundation damage

- Pest control issues

Fortunately, there are steps you can take to prevent water backups, avoid water damage in homes, and protect your family from costly out-of-pocket repairs. These include:

- Protect your home’s plumbing by properly disposing of grease, paper products, hygiene products, and other items that block pipes

- Regularly inspect and tend to trees to avoid root overgrowth

- Replace your lines with plastic pipes to keep roots from causing damage

- Repair any illegal or improperly installed plumbing connections that could lead to sewer backups

- Install a sump pump or backwater prevention valve to help prevent problems

- Take the time to properly clean up any water to avoid long-term damage and mold growth

- Ensure you have the proper insurance coverage for your home and keep your policy up to date

Reach out to us to discuss home insurance & tailored coverage options when it comes to water damage.

Key Water Damage Stats

Source: Insurance Information Institute

- Around 14,000 people in the U.S. are affected by water damage daily.

- The average insurance payout for water damage is $11,605.

- About 1 in 60 insured homes makes a claim for water or freezing damage each year.

- 99% of U.S. counties were impacted by a flood event between 1996-2019.

- 98% of basements in the U.S. will experience some water damage at least once.

- The typical price range to restore water damage across is between $1,240 and $5,342.

- Americans waste roughly 1 trillion gallons of water yearly due to leaky pipes, faucets, sprinkler systems, and more.

How Many Water Damage Claims are Made Each Year?

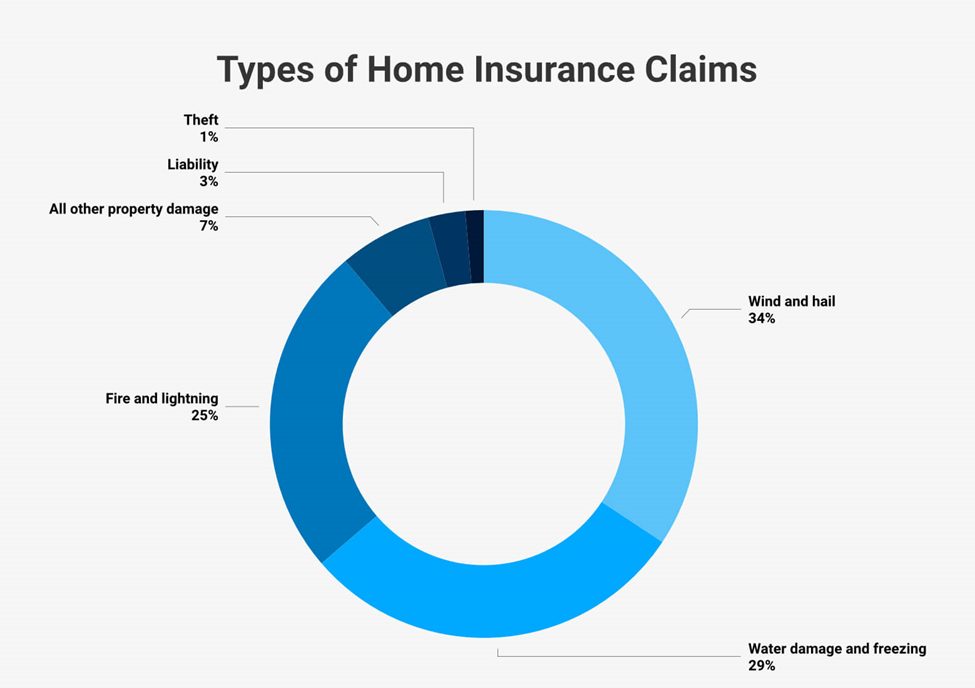

- Water damage is a pervasive problem; in fact, it is the second most common home insurance claim behind damage from wind and hail.

- Water damage affects around 14,000 people in the U.S. every single day. Said another way, about 1 in 60 insured homes make a claim for water or freezing damage each year. On a percentage basis, this translates to 1.6% of homes nationwide that will experience water damage in any given year.

- Around 29.4% of all home insurance claims were due to water damage and freezing, which is second only to wind and hail damage (34.3% of all claims).

Here is a table of home insurance claims by type:

| Type of Home Insurance Claim | Percentage of Total Claims |

| Wind and hail | 34.3% |

| Water damage and freezing | 29.4% |

| Fire and lightning | 25.1% |

| All other property damage | 7.0% |

| Liability | 2.8% |

| Theft | 1.4% |

The Cost to Fix Water Damage

Source: HomeAdvisor

Water damage restoration professionals classify water damage into 4 classes, with Class 1 being the least severe. Here’s an overview of each of the classes:

Class 1 – Slight water damage to part of a single room. Savvy DIY homeowners may be able to repair class 1 water damage themselves.

Class 2 – Water damage throughout an entire room, including the walls up to 12 inches.

Class 3 – Water damage that reaches an entire room or multiple rooms. Class 3 damage typically affects numerous parts of rooms, such as ceilings, walls, subflooring, and insulation.

Class 4 – The most severe type of water damage from water that has been long-standing or from a weather event such as a flood or storm surge. Damage in this class often affects structural materials such as brick, stone, and hardwood.

Restoration costs on the low end for Class 1 water damage that is dealt with quickly can be as little as $150. On the high end, severe Class 4 water damage can result in restoration costs amounting to hundreds of thousands of dollars. Here we can see typical restoration price ranges for each class of damage:

| Extent of Water Damage | Average Price Range For Restoration |

| Class 1 | $150-$400 |

| Class 2 | $500-$1,000 |

| Class 3 | $1000-$3,000 |

| Class 4 | $20,000-$100,000 |

Water Damage Costs & Area of The Home

Source: HomeAdvisor

Restoration costs can also vary depending on what is affected by water damage. For example, restoring a bathroom fixture may cost between $150-350, whereas restoring plumbing is more likely to cost between $1,000-4,000. Here is a table showing the prices to make repairs to different areas of the home:

| Area of the Home | Price Range To Repair |

| Bathroom fixtures | $150-$350 |

| Floors | $200-$500 |

| Drywall | $300-$800 |

| Ceiling | $350-$1,250 |

| Roof | $400-$1,700 |

| Basement | $500-$80,000 |

| Plumbing | $1,000-$4,000 |

Contact Us today for Auto and Home solutions and learn more about how we can help. Give us a call at 603-431-4020, email at insure@portsmouthatlanticins.com or fill out the form on this page to get started.

Be sure to follow us on Facebook & Instagram to stay up-to-date on the latest news and tips in the insurance industry. We’re always sharing helpful insights and advice that can help you protect yourself and your assets.

We proudly serve residents in New Hampshire, Massachusetts, Vermont, Maine, Connecticut, Rhode Island, New York, Ohio, Illinois & Florida